Every keyword in Google Ads is assigned a recommended value of CPC (Cost-Per-Click) to rank on the first page of search results. Depending on the industry, CPC can get very expensive. In some instances, first-page CPC can cost well over $20 in a single click, which quickly exhausts the marketing budget.

Search Engine Marketing Intent-Based SEM Keyword Research

Less costly, more search intent-based keywords are just as effective in search engine marketing campaigns. Receiving clicks is great, but converting visitors into revenue is the ultimate goal of search engine marketing. By choosing the right targeted keywords with high conversion, you can discover lucrative niche markets that work with a reasonable marketing budget.

SEM Keyword Research Tools Improve Search Engine Marketing Results

SEM keyword research tools help to identify the top keywords with the lowest cost per acquisition and highest conversion rate.

Example of How SEM Keyword Research Tools Improve SEM Marketing Campaigns

For example, discovering long-tail keywords (extended phrases that typically yield lower search volume but provide a more precise intent behind the searched terms) costs much less in cost-per-click rates and lowers the cost per acquisition. At the same time, visitors who use long-tail keywords in search tend to be more specific about what they are looking for and are more likely to become ready-to-buy customers.

Critical Metrics of SEM Marketing Campaigns

It is crucial to understand the following three SEM campaign calculations to determine the success of search engine marketing campaigns.

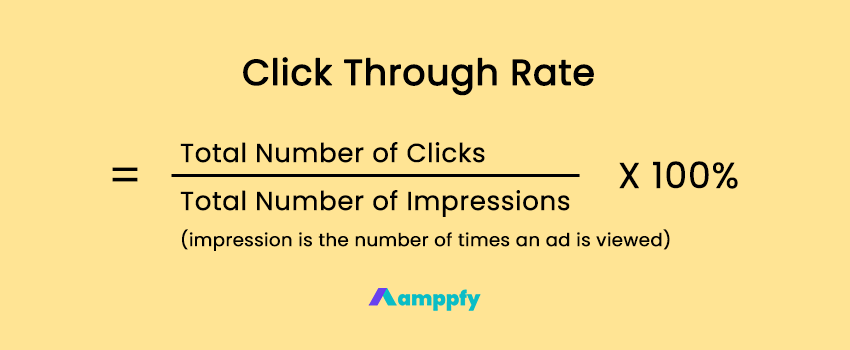

Calculation #1: SEM Click Through Rate

The SEM CTR or click-through rate metric determines whether an ad can generate good visitor engagement. The higher the CTR, the better the ad performance.

How to Calculate SEM Click Through Rate

Click-through rate is calculated by the number of clicks divided by the number of impressions. Multiply the value by 100 to get a click-through rate percentage. A reasonable click-through rate for an SEM marketing ad is typically around 1%. The CTR can increase or decrease depending on the industry and the ad messaging.

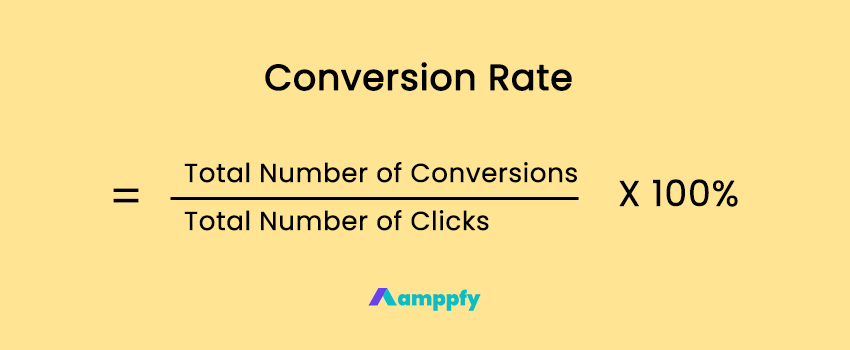

Calculation #2: SEM Conversion Rate

SEM conversion rate is another critical metric to monitor closely because it controls the SEM marketing campaign’s ROI (Return on Investment). Conversion in an SEM campaign is the number of leads or sales gained through clicks of the SEM ad.

How to Calculate SEM Conversion Rate

The SEM conversion rate is calculated by the number of conversions divided by the number of clicks. Multiply this value by 100 to get a conversion rate percentage. Depending on the business type, the average conversion rate varies by industry.

Calculation #3: SEM Cost Per Acquisition

SEM cost per acquisition determines the cost per conversion for SEM marketing campaigns. It tells you if the marketing dollar spent on an ad campaign is worth the price base on the volume and quality of the converted leads.

How to Calculate SEM Cost Per Acquisition

Cost per acquisition is calculated by the total ad campaign cost divided by the total number of leads converted. The value is a dollar amount representing how much an ad campaign costs to make the conversion happen.

Top 3 Benefits of Running SEM Marketing Campaigns

SEM marketing campaigns can achieve fast-tracked results with a defined budget and proper execution. Here is what to expect.

#1. SEM Marketing Delivers Targeted Paid Search Traffic

Unlike SEO marketing, which takes some time to see results, SEM delivers targeted traffic by displaying ads in top positions of search result pages within Google or Bing. Including high search volume keywords in SEM ad messaging increases search visibility and improves conversion opportunities.

#2. Cost-Control SEM Marketing Ad Campaigns

You decide how much to pay for each keyword click in an SEM ad campaign, so the cost is transparent. However, running ads can get expensive. SEM campaign cost management takes more than budget control. Use SEM keyword research tools to identify lucrative long-tail keywords that improve and accelerate the campaign to convert more traffic into customers.

Example of an SEM Ad Campaign Opportunity Cost

Let’s use the SEM pay-per-click campaign as an example. If you pay $0.50 per click, with 10,000 clicks, you will end up with a $5,000 ad spend. If 3% of those clicks convert into a sale with a $50 profit, then you are looking at a $15,000 earning. A 200% ROI ratio is a good start to a feasible marketing campaign budget plan.

#3. SEM Focuses on Targeted Marketing Campaigns

Unlike traditional marketing, which targets as many people as possible and hopes some will become customers, search engine marketing is a more targeted digital marketing approach. SEM focuses on prospects who have already shown preliminary interest in your offer. SEM marketing hones in on a niche target audience that fits specific demographic criteria, making the ad campaign more effective.

Example of a Targeted SEM Campaign

For example, use ad scheduling and geolocation settings to customize target audience reach in an SEM campaign. Then put it to the test and create a campaign that makes conversion happen. Learn how SEM ad scheduling and SEM geolocation customization reduce ad spending and hyper-target visitors with the highest opportunity to convert into customers based on data.

Focus on SEM Conversion Rate Improvements

A feasible plan and strategies set the foundation for a winning SEM campaign. The best advice for a successful search engine marketing ad campaign is to focus on the conversion rate and not become fixated on the clicks. Make sure you are comfortable with the marketing budget, and continue refining the SEM campaign until you have identified the highest converting ad campaign strategy.