Amppfy Takeaways

- Set Milestones: Break your big savings goal into smaller targets (e.g., 25%, 50%, 75%) and celebrate each milestone to maintain momentum.

- Use Visual Reminders: Place images or charts of your goal (dream home, vacation spot, etc.) where you’ll see them daily to keep your motivation high.

- Reward Small Wins: Treat yourself modestly when you hit mini‑goals—like a favorite snack or a new book—to reinforce positive saving habits.

- Stay Flexible and Review: Regularly revisit and adjust your plan—tweaking timelines, contributions, or goals—to account for life changes and keep your strategy realistic.

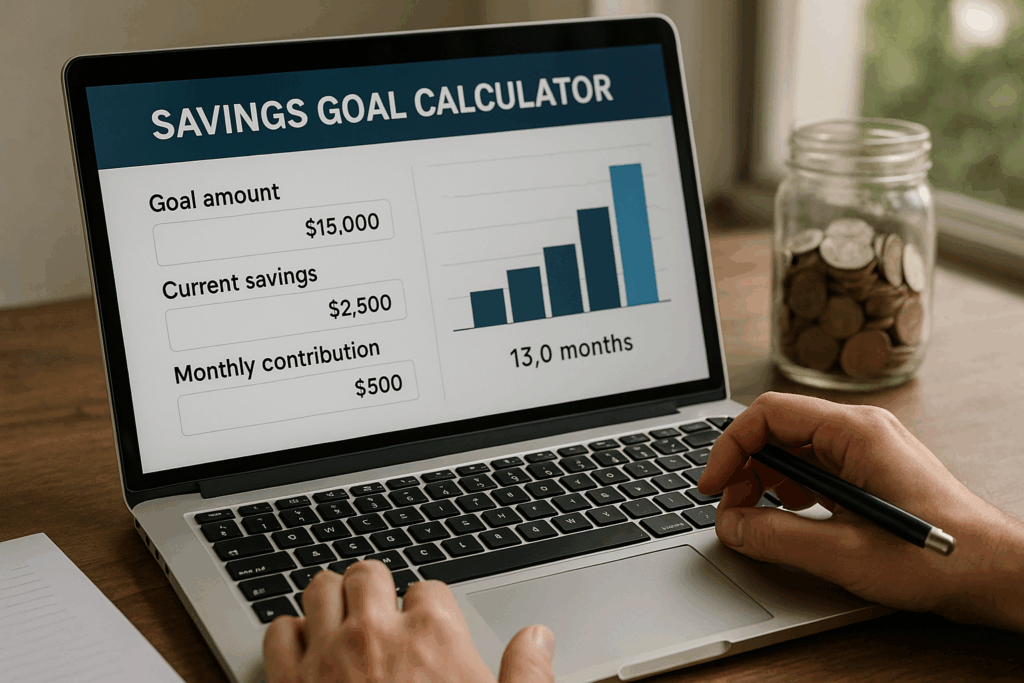

First step in your financial journey is setting a savings goal. Whether you’re saving for a vacation, a new car, or a down payment on a home, having a target in mind can help you create a plan to reach it. A savings goal calculator can help you see how much you need to save each month to reach your goal. It can also help you see how different things, like how much you put down and how much interest you get, can affect how long it takes. In this post, we’ll show you how to use a savings goal calculator to set a realistic time for your goal. We’ll also share some tips to help you stay on track.

Why a Clear Target Matters

A savings goal isn’t just a number on a piece of paper. It’s a powerful motivator that can transform your financial life. By setting a clear savings goal, you give yourself a tangible target to work towards, whether it’s saving for a dream vacation, a new car, or a down payment on a house. This target helps you stay focused and provides a clear sense of direction, making it easier to manage your finances effectively.

How Priorities Sharpen Spending

The Beauty Of A Savings Goal Is That It Compels You To Prioritize Your Expenses. With A Specific Target In Your Sights, You’re More Inclined To Assess Your Spending Patterns And Trim The Fat Off Non-Essential Costs. This Level Of Attention Can Yield Significant Savings Over Time, As You Develop A Heightened Awareness Of Your Financial Outflow. You’ll Opt To Forego That Daily Latte Or Embrace Home-Cooked Meals, Recognizing That Each Penny Saved Is A Step Closer To Your Goal.

Small Wins Build Confidence

Not Only That, But Achieving Small Savings Goals Can Also Have A Profound Impact On Your Financial Confidence. When You Set And Reach Short-Term Goals, Like Saving $500 For An Emergency Fund, You Feel Accomplished And Motivated. This Positive Reinforcement Encourages You To Continue Developing And Maintaining Consistent Saving Habits. Over Time, These Small Wins Can Add Up To Substantial Financial Progress, Making It Easier To Tackle Larger, Longer-Term Goals.

Adapt As Life Changes

Regularly Revisiting Your Savings Goals Is Another Crucial Aspect Of Successful Financial Planning. Life Is Full Of Unexpected Changes, And Your Financial Priorities May Shift Over Time. By Periodically Reviewing And Adjusting Your Savings Goal, You Ensure That It Remains Relevant And Achievable. This Flexibility Allows You To Stay Motivated And On Track, Even When Faced With New Challenges Or Opportunities.

How to use a savings goal calculator

A savings goal calculator might seem hard at first, but it’s a simple tool that can make your financial planning easy. The first step is to input your total savings goal. This is the amount you aim to save by a specific date. For example, if you want to save $10,000 for a down payment on a house in five years, you would enter $10,000 as your total savings goal. This helps you visualize your target and keeps you focused on what you need to achieve.

Enter Your Big-Picture Goal

Now, let’s talk about timelines. Be practical about when you want to hit your goal. Whether it’s a quick win like a vacation in a year or a long-haul like retirement in 20-30 years, your financial standing and the urgency of your goal should guide you. Our calculator will fine-tune your timeline based on what you’re saving and contributing, so you can be sure your goal is within reach.

Set a Realistic Timeline

Once your timeline is in place, input your current savings. This is a pivotal step, as it illuminates the distance between your present and your financial goals. By feeding the calculator with your current savings, it will reveal the amount you need to save to meet your goal. This knowledge is the foundation of a pragmatic savings plan and will keep you motivated.

Account for Existing Funds

Opting for regular contributions is yet another hallmark of the savings goal calculator. You can automate contributions from your paycheck or bank account to maintain your trajectory. Witness the power of compound interest as the calculator shows how these contributions will burgeon over time. This feature not only fosters consistency but also offers a real-time view of the impact of your efforts.

Leverage Automation and Compounding

And don’t forget to play around with different scenarios. What if you could contribute an extra $50 each month? Or what if you earned a higher interest rate? The calculator can show you how these changes might impact your timeline and your savings. This can help you make more informed decisions about your financial strategy and stay motivated to reach your goals.

Explore “What‑If” Scenarios

From building an emergency fund to saving for a dream vacation, common savings goals are within reach if you know the right strategies to employ. One of the most significant financial milestones for many people is purchasing a home. Saving for a down payment can seem daunting, but with a clear savings goal and a systematic approach, it becomes more manageable. Start by determining the total amount you need for the down payment. A common rule of thumb is to aim for 20% of the home’s purchase price to avoid private mortgage insurance (PMI). Once you have your target amount, divide it by the number of months you plan to save. For example, if you need $20,000 for a down payment and plan to save over two years, you would need to save about $833 per month. Consistency is key, so automate your savings by setting up a monthly transfer to a dedicated savings account.

Home Down Payment Made Doable

Equally important is the establishment of an emergency fund. This financial cushion is your buffer against life’s unexpected blows, be it a sudden illness, a car breakdown, or a job loss. The rule of thumb is to have three to six months’ worth of living expenses stashed away. Calculate your monthly outlay for essentials like housing, food, utilities, and transport. Then, let a savings goal calculator help you in devising a plan that aligns with your financial reality. For example, if your monthly essentials tally up to $3,000 and you’re aiming for a six-month safety net, the math tells you to save $18,000. Spread over a year, that’s $300 each month.

Building Your Safety Net

And then there’s the grand finale: planning for a vacation. It’s a thrilling prospect, but one that requires a methodical approach. Whether you’re envisioning a sun-soaked retreat or a family odyssey, the secret is to tally up the costs—travel, lodging, dining, and activities—and then devise a budget. Use a savings goal calculator to pinpoint your monthly target. Let’s say your dream vacation is a $2,000 affair six months down the line—that’s roughly $333 a month. Keep going by creating a vacation fund. This is a separate savings account where you can watch your money grow and be motivated by the money you have.

Funding Your Dream Trip

To stay motivated on your savings journey, it’s like keeping a long-term relationship. It needs to be committed, check in sometimes, and be creative. One effective way to keep your spirits high is by setting milestones for major goals. For example, if you’re saving for a vacation, break down the total amount into smaller, manageable chunks. Each time you reach one of these milestones, you’ll feel a sense of accomplishment that can boost your motivation to keep going. This approach not only makes the goal seem more achievable but also provides regular opportunities to reflect on your progress.

Break Goals Into Milestones

Visual aids are powerful. Whether it’s a snapshot of your dream car or the idyllic beach where you hope to vacation, having a visual cue can make your savings target feel more concrete. Place it where you’ll see it daily, like on your fridge or as your phone’s screensaver. This constant reminder can help you remain dedicated to your financial plan, even during challenging times.

Use Daily Visual Reminders

Recognizing the small wins is also key to keeping the fire burning. At 25% of your target, indulge in a modest treat. It could be a delightful meal, that book you’ve been eyeing, or a brief escape. These little rewards act as a pat on the back, transforming the act of saving from a mundane task to a more gratifying effort. Over time, these moments of celebration accumulate, fortifying your determination to achieve your grand financial aspirations.

Celebrate Each Milestone

By integrating these methods into your financial blueprint, you can reframe a formidable challenge into a series of surmountable goals. Keep in mind, the path to financial liberty is a marathon, not a sprint. Maintain your composure, your focus, and witness your aspirations materialize.