Share via:

-

Save

Amppfy Takeaways

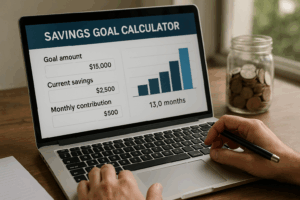

Leverage a Mortgage Calculator: Use our free tool to quickly estimate your monthly payments, total interest, and annual amortization so you can budget accurately.

Master Key Mortgage Terms: Understand principal, interest, APR, PITI, and PMI to compare loan offers and avoid surprises.

Account for All Costs: Factor in property taxes, homeowners insurance, closing fees, appraisal and title insurance, and discount points to reveal the true cost of homeownership.

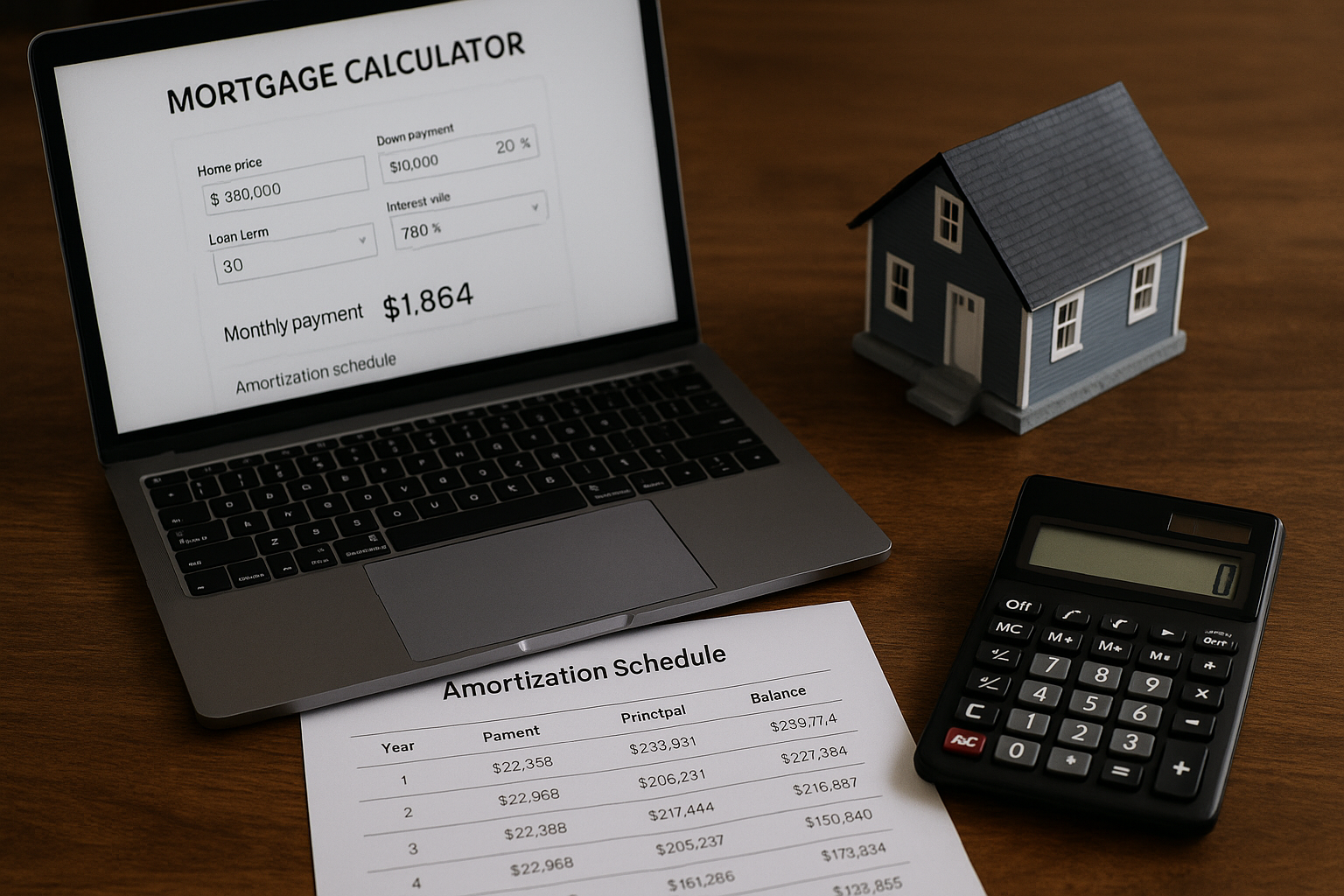

Read Your Amortization Schedule: Review how each payment shifts from interest-heavy to principal-heavy over time to track equity growth and interest savings.

Choose the Right Mortgage Type: Weigh the predictability of fixed-rate loans against the potentially lower initial rates (—and risks) of ARMs to find the best fit for your long-term plans.

Buying a home is a big deal. You should feel confident about how you’re financing it. We give you all the facts with sound advice, competitive mortgage rates, and flexible terms. So you feel right at home no matter which way the market is going.

Understanding The Basics Of Mortgage Calculations

Introduction To Mortgage Calculators

To truly understand the cost of your home, it’s essential to dive into the basics of mortgage calculations, which we’ll explore in this section. One of the most useful tools at your disposal is a mortgage calculator. This handy tool can help you estimate your monthly payments and the total cost of your mortgage over time. By inputting details such as the loan amount, interest rate, and loan term, a mortgage calculator provides a clear picture of what you can expect to pay each month and over the life of the loan.

The Role Of Principal And Interest

At the core of any mortgage calculation are two key components: the principal and the interest. The principal is the initial amount of money you borrow to purchase your home. Over time, as you make payments, this amount decreases. The interest, on the other hand, is the cost of borrowing the principal. It is calculated as a percentage of the outstanding loan balance and is paid to the lender. The interest rate can vary based on factors such as your credit score, the type of loan, and current market conditions.

Understanding Amortization Schedules

Equally important to grasp is the amortization schedule. This detailed timetable delineates each monthly payment, dissecting the allocation between principal and interest. In the initial stages, a significant portion of your payment is channeled into interest. Yet, with each payment, the balance tips, and a larger slice is directed at chipping away at the principal. This gradual change is the main part of the amortization schedule. It is a useful tool for figuring out how your mortgage will affect your money in the future.

Incorporating Taxes And Insurance

Principal and interest are just the beginning. Property taxes and homeowners insurance are added to your monthly mortgage payment, and may be placed in an escrow account. These costs can change over time. Your total monthly payment can also change, so use our calculator to find out how your payment will change over time.

Planning With Mortgage Terms

By understanding these mortgage terms and calculations, you can better plan your finances and make decisions with confidence. This will help you choose the right mortgage for your needs and budget for the long term. Once you understand the basics, you can navigate the complexities of home financing with greater clarity and confidence.

Key Terms You Need To Know For Accurate Estimates

Overview Of Key Mortgage Terms

Before we proceed to the estimates, let’s get you acquainted with some key terms that will serve as your guide through the mortgage landscape. We have amortization. This is the process by which a mortgage is paid off over time through regular payments. Each of these payments has both principal and interest. The amortization schedule shows how much of each payment is used for principal and how much for interest. Over the loan’s life, the amount of money paid in interest changes. As time goes by, more money goes to the principal.

Annual Percentage Rate (APR) Explained

APR, or Annual Percentage Rate, is another key term to grasp. The APR is a more complete measure of how much you pay to borrow money than interest rates alone. It includes other fees and charges that come with the mortgage. It’s a great tool for comparing different mortgage offers. Lenders must share it, so you can make smarter decisions.

Breaking Down PITI Components

Let’s talk about your monthly mortgage payment. You’ll often hear the term PITI being thrown around. This acronym stands for Principal, Interest, Taxes, and Insurance—the four key components of your payment. The principal is what chips away at your loan balance, while interest is the cost of borrowing the money. Taxes are the property taxes you’ll need to pay. Insurance includes homeowners insurance and, if applicable, private mortgage insurance. Getting a grip on PITI is essential for budgeting and ensuring you can handle the total monthly cost of your mortgage.

Understanding Private Mortgage Insurance

PMI, or Private Mortgage Insurance, is an extra fee that may be required if you pay less than 20% of the home’s value. This insurance protects the lender in case you default on the loan. While PMI can add to your monthly payment, it’s often a necessary step for first-time homebuyers or those with limited savings. Once you have enough money in your home—usually 20%—you can ask to have PMI taken off, which will lower your monthly payments.

Uncovering The True Cost Of Your Mortgage

Using Calculators To Estimate Total Costs

While the monthly payment is a crucial factor, uncovering the true cost of your mortgage involves looking beyond the surface. A mortgage calculator is a must-have tool. It can help you estimate not just your monthly payments but also the total cost of your loan over time. These calculators consider many things, like the loan amount, interest rate, loan length, and other costs. This gives a more complete financial overview. By using a mortgage calculator, you can get a clearer picture of how much you will pay over the life of your mortgage, which can be significantly more than the initial monthly payment suggests.

Accounting For Closing, Taxes, And Insurance Fees

Beyond the monthly payments, there are several other costs that can significantly impact the total amount you pay for your mortgage. One-time closing costs can be from 2% to 5% of the loan amount. They include fees like the application fee, loan origination fee, and the cost of an appraisal. Property taxes are another cost that can vary by location and can increase over time. Homeowners insurance is a must-have, and it protects you and your lender in the event of damage to your property. It’s important to consider these ongoing costs when creating your budget to avoid any surprises later. Calculating costs in addition to principal and interest is an important step in understanding the full financial commitment you are making.

Evaluating APR And Hidden Fees

Understanding the explanation of terminology can also shed light on the true cost of your mortgage. The Annual Percentage Rate (APR) is a term that often gets overlooked but is incredibly important. Unlike the interest rate, which only shows the cost of borrowing the whole amount, the APR includes both the interest and other fees. This gives you a more accurate picture of the cost of your mortgage each year. This can help you compare different loan offers and make an informed decision. Additionally, hidden costs such as appraisal fees and inspection fees can add up quickly. Lenders often require these fees to ensure the property’s value and condition meet their standards. Being aware of these costs can help you prepare a more realistic budget and avoid last-minute financial strain.

Navigating Additional Mortgage Fees And Charges

Appraisal And Title Insurance Fees

Additional fees and charges can add significant amounts to your mortgage, so it’s crucial to navigate these waters carefully. One of the first hidden fees you might encounter is the appraisal cost. This fee covers the cost of having a professional appraiser evaluate the property to ensure its value matches the loan amount. While it might seem like a minor expense, it can add several hundred dollars to your closing costs. Another important fee is title insurance. This protects you and your lender from any problems with the property’s title, like liens or disagreements. Title insurance is typically a one-time fee, but it can be substantial.

Understanding Closing Fees

Closing fees are yet another aspect that can take you by surprise. These encompass a range of costs, from attorney fees to processing and underwriting fees. The sum can fluctuate greatly based on your location and the intricacies of your loan. A mortgage calculator can provide an estimate, but it’s wise to request a comprehensive breakdown from your lender to ensure a smooth closing without any unforeseen expenses.

Assessing PMI Costs

Private mortgage insurance (PMI) is another big cost that can affect your monthly payment and the total cost of your home. If your down payment is less than 20% of the home’s purchase price, PMI is likely to be required. This insurance shields the lender in the event of a loan default, with the cost typically incorporated into your monthly mortgage payment. While PMI is often necessary, comprehending its implications for your financial landscape is crucial. Use a mortgage calculator to measure the cost of PMI and its impact on your monthly payments and long-term savings.

Evaluating Discount Points

Discount points, on the other hand, are an upfront cost that can lower your monthly mortgage payment. Each point typically costs 1% of the loan amount and lowers your interest rate by about 0.25%. Whether it makes sense to buy discount points depends on how long you plan to stay in the home and how much you can afford to pay upfront. If you plan to stay in the home for a long time, the lower interest rate will save you more over the life of the loan. If you don’t plan to stay in the home for long, you may not recoup the cost of the discount points. A mortgage calculator can help you weigh the pros and cons by showing you the long-term savings and the break-even point.

Breaking Down The Mortgage Payment: Principal, Interest, And More

Components Of The Mortgage Payment

Breaking down your mortgage payment into its components—principal, interest, and more—can help you understand what you’re paying for each month. You can think of it in terms of a pie, where your monthly payment is divided up among the various services your lender provides. Most of your payment usually goes to pay off the interest and principal. But there may be taxes or insurance as well. For example, with a $300,000, 30-year loan at a 4% fixed rate, your monthly principal and interest payments would be around $1,430. But that’s not all you’ll have to pay for each month.

Impact Of Taxes And Insurance

Understanding the impact of these components on your total payments is crucial for managing your finances effectively. Local governments charge property taxes to pay for public services. The taxes are usually based on how much a property is worth. They can vary depending on where you live. Insurance protects you and the lender from financial loss. It is standard to include homeowners insurance in your monthly mortgage payment. The average annual homeowners insurance premium is about $1,200. You can also pay for insurance separately from your mortgage.

Importance Of Amortization Schedules

Amortization schedules are a key part of how your mortgage payment is structured. An amortization schedule is a detailed table that shows how each payment is divided between the principal and interest over the life of the loan. At the start, a larger portion of your payment goes toward interest, but as time goes on, more of your payment is applied to the principal. This is why your interest payments decrease over time, even if your monthly payment stays the same. By understanding your amortization schedule, you can see how your payments are reducing your principal balance and, as a result, the amount of interest you pay.

Fixed-Rate Vs Adjustable-Rate Mortgages

The choice between a fixed-rate mortgage and an adjustable-rate mortgage (ARM) can have a significant impact on your monthly payments and long-term costs. With a fixed-rate mortgage, the interest rate and the size of your monthly payment remain the same for the entire term of the loan. This predictability can make budgeting easier and provide peace of mind. An ARM has an interest rate that can change periodically, causing your monthly payment to go up or down. While ARMs may offer lower initial rates, the potential for payment increases in the future could be a problem. Weighing the risks and benefits of each type of mortgage is an important step in the homebuying process.

Continue the Learning Journey with Amppfy

Amppfy’s digital marketing resource library is beginner-friendly, and zero technical or marketing experience is required to get started. Learn how to create a practical, actionable, and programmatic digital marketing playbook for any business website, e-commerce store, or content platform. Leverage effective SEO, SEM, and social media strategies to boost brand authority, increase online visibility, and generate quality demand.

Follow us on LinkedIn, Facebook, Instagram, and YouTube to stay updated on the latest marketing news, strategies, and free content.

Get Started with Free Generative AI Marketing Tools

- 100% Free

- No Account Required

- Available 24/7

Share via: